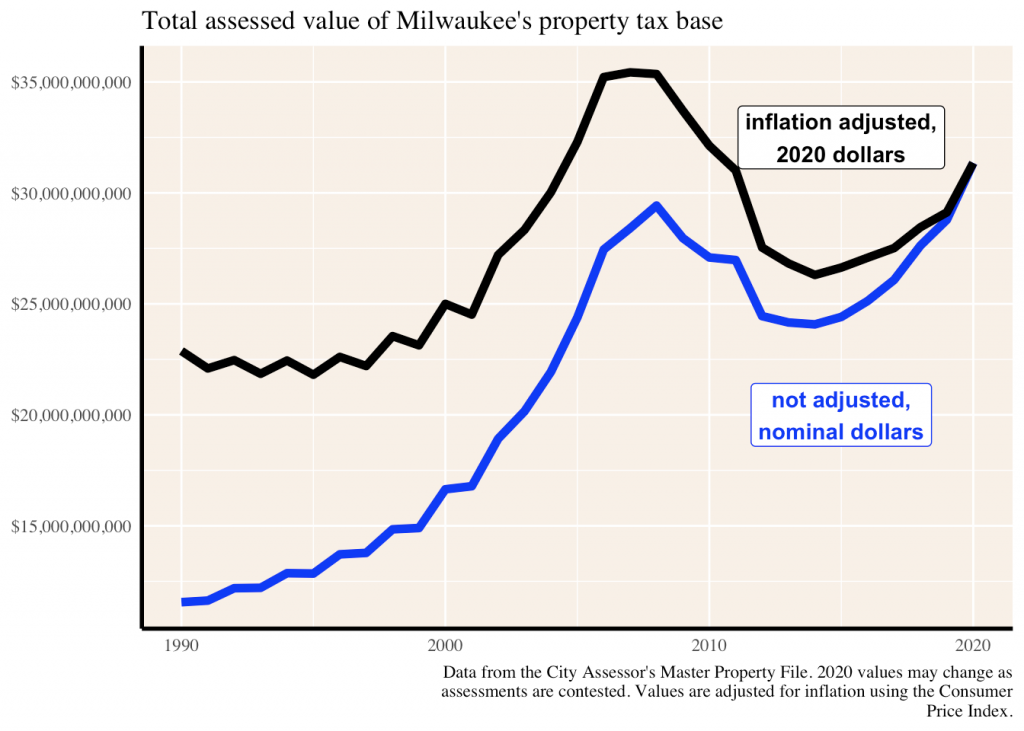

The 2020 total value of Milwaukee’s tax base is $31.4 billion, up $2.2 billion from 2019, but still $4.1 billion less than the peak in 2007. The city’s total assessment grew 7.6% from 2019 to 2020. This is the largest year-over-year increase since 2005-2006.

Unless stated otherwise, all values in this post are adjusted for inflation to current (2020) values using the Consumer Price Index.

In unadjusted (“nominal”) dollars, the city’s total 2020 valuation exceeded its 2008 peak for the first time. Homeowners who bought their properties near the top of the pre-Recession market will be glad to see their home values approach the sale price, but apart from this the nominal dollar comparison has little value.

By law, the assessments released in April 2020 are intended to reflect the value of the property on January 1, 2020, so they do not take into consideration the current economic turmoil facing the entire nation. As research from the Public Policy Forum has shown, municipalities in Wisconsin are disproportionately dependent on property taxes compared to local governments in other states. Usually this lack of a diversified income stream is a bad thing, but in this case it may shelter municipalities from even worse fiscal fallout for at least another year.

The residential picture

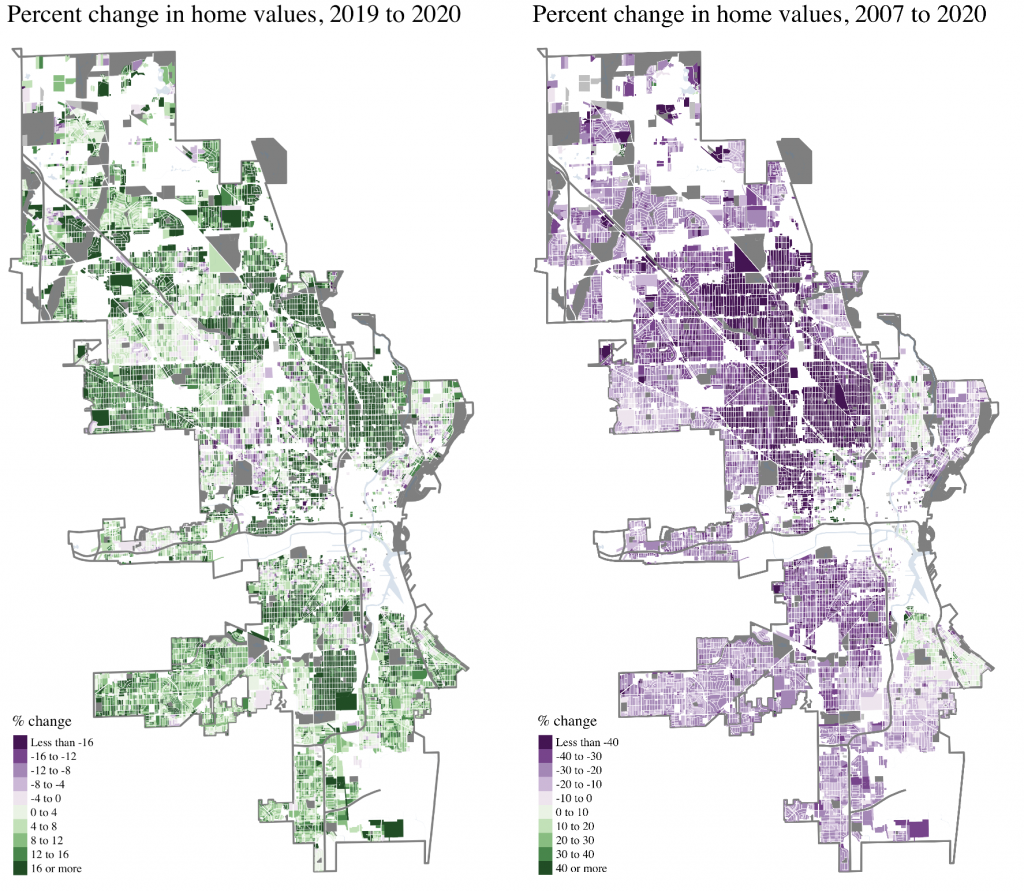

The average residential property assessment in 2020 was $115,700. The median home’s assessment grew 9.9% from 2019 to 2020, or $9,800. Home valuations increased for 82% of homes and decreased for 12%.

Among neighborhoods with at least 200 homes, values grew the most in Brewer’s Hill ($46,000 on average). Murray Hill, on the other side of the Milwaukee River, saw the largest decline ($9,000). Other neighborhoods with large increases include Harambee, Mount Mary, Maple Tree, and Riverwest. In addition to Murray Hill, property values declined in Riverside Park, Uptown, Clock Tower Acres, Granville Station, Washington Park, and Sherman Park.

There are a handful of neighborhoods where property values in 2020 are higher than in 2007. They include neighborhoods near the Lake such as Bay View, Fernwood, Harbor View, the Historic Third Ward, and Yankee Hill; the two near-north side neighborhoods of Triangle and Triangle North; and a cluster of far-northwest side developments near Dretzka Park.

These neighborhoods are by far the exception to the general trend. As of 2020, the median home in Milwaukee is assessed at 73% of it’s value in 2007–an average decline of $42,000.

Click here for an interactive table showing the median values of residential properties in each Milwaukee neighborhood for the years 2000, 2007, 2019, and 2020.

This is both good and bad.Were we to have kept the Residency Requirement-a policy that really served Milwaukee well for over 75 years-I dare say that the decline average in property values would have been less,or might even have caused an over all rise in property values. (I hope there is now some way that City workers can be enticed to live in the City by other means.) I believe there are two mitigating factors that can greatly , and almost immediately, inspire an uptick in property values. These are my personal beliefs, having thought about the Milwaukee scene for many years. They are as follows:

1. Milwaukee has a big problem with noise -especially from automobiles-in the form of “boom box” music.

The current laws against this noise must be vigorously enforced.

2.Milwaukee suffers from an appearance problem in too many areas because of litter. Neighborhoods must be inspired to clean up litter:beginning and ending with property owners.

In the neighborhoods whose assessments are higher, there is ALWAYS very little obnoxious noise snd very little litter.

So….What we are talking about here is the “Broken Window Theory”.

Were these two items-alone , and in their own merit- to be ameliorated, there would be an immediate increase in livability in Milwaukee and a fringe benefit of such would be an increase in property values.

Why so? Because noise snd litter are harbingers of crime…That’s why…!