City of Milwaukee home sales fell to pre-pandemic levels through the first quarter of 2023. Slightly more than 1,400 houses were sold in self-reported arm’s length transactions during the first three months of this year. That is down from nearly 2,100 in both 2021 and 2022, but it is similar to the sale volume in 2018 and 2019.

The statistics in this article are derived from a custom dataset matching state transaction records with city parcel data. Due to delays in the reporting process, the 2023 statistics are preliminary, and the final totals will likely be slightly higher than at present. About 1.5% of transactions could not be matched and are not included in this analysis.

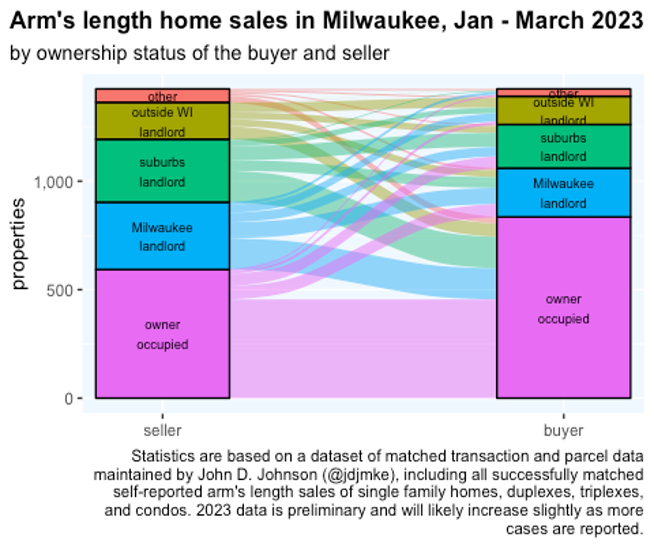

Most notably, out-of-state landlords dramatically slowed their pace of acquisitions. Their share of arm’s length home sales fell from 20% in the first quarter of 2022 to just 9% in 2023. The proportion of purchases by owner-occupiers and city or suburban-based landlords all ticked upwards compared to the last two years.

Owner-occupiers accounted for 59% of arm’s length home purchases in January, February, and March of 2023. City-based landlords bought another 16% and suburban landlords 14%.

Table 1: First quarter arm’s length home sales in the City of Milwaukee

| Jan – March | Buyer type | |||||

| sales | owner occupied | Milwaukee landlord | suburbs landlord | outside WI landlord | other | |

| Q1 2018 | 1,511 | 55% | 17% | 15% | 11% | 2% |

| Q1 2019 | 1,515 | 56% | 17% | 14% | 10% | 2% |

| Q1 2020 | 1,614 | 60% | 15% | 11% | 11% | 3% |

| Q1 2021 | 2,070 | 57% | 15% | 12% | 15% | 2% |

| Q1 2022 | 2,097 | 53% | 13% | 12% | 20% | 2% |

| Q1 2023 | 1,425 | 59% | 16% | 14% | 9% | 2% |

| Statistics are based on a dataset of matched transaction and parcel data maintained by John D. Johnson (@jdjmke), including all successfully matched self-reported arm’s length sales of single family homes, duplexes, triplexes, and condos. 2023 data is preliminary and will likely increase slightly as more cases are reported. | ||||||

Table 2 shows the mix of sellers by ownership type. The share of sellers who were owner-occupiers ticked up slightly, from 38% in 2022 to 42% in 2023.

In total, the share of sales involving an owner-occupier (either as the seller, buyer, or both) grew to 68% in 2023 compared to 61% in 2022.

Table 2: First quarter arm’s length home sales

in the City of Milwaukee

| Jan – March | Seller type | |||||

| sales | owner occupied | Milwaukee landlord | suburbs landlord | outside WI landlord | other | |

| Q1 2018 | 1,511 | 39% | 21% | 18% | 10% | 11% |

| Q1 2019 | 1,515 | 37% | 22% | 20% | 10% | 10% |

| Q1 2020 | 1,614 | 41% | 23% | 21% | 10% | 6% |

| Q1 2021 | 2,070 | 40% | 26% | 21% | 9% | 4% |

| Q1 2022 | 2,097 | 38% | 23% | 20% | 12% | 6% |

| Q1 2023 | 1,425 | 42% | 22% | 20% | 12% | 4% |

| Statistics are based on a dataset of matched transaction and parcel data maintained by John D. Johnson (@jdjmke), including all successfully matched self-reported arm’s length sales of single family homes, duplexes, triplexes, and condos. 2023 data is preliminary and will likely increase slightly as more cases are reported. | ||||||

Notice that owner-occupiers made up 59% of sellers but just 42% of buyers in the first quarter of 2023. This is because owner-occupiers buy the lion’s share of properties sold by other owner-occupiers along with a substantial fraction of the houses sold by landlords.

Owner-occupiers bought 77% of houses sold by other owner occupiers, 46% of those sold by city-based landlords, 50% of sales by suburban landlords, and 36% of houses sold by out-of-state landlords.

Arm’s length home sales are a net source of new homeowners, but it’s important to note that this doesn’t necessarily translate into similarly high overall growth numbers of homeowners. Owner-occupancy experiences substantial attrition from non-arm’s length property conveyances (such as family transfers). Houses also cease to be owner-occupied when their resident owner moves out and converts it into a rental–a common occurrence in Milwaukee.

The volume of home sales may have plummeted, but prices haven’t followed suit. The pace of price increases tapered off, but typical home sales were still slightly more expensive in first quarter of 2023 than a year prior.

Through March of this year, the median overall home sale price was $150,000, compared with $148,000 a year ago and $130,000 in 2021. Among owner-occupiers, prices increased to $190,000 on average, up from $185,000 last year. Landlords pay much less. The typical landlord acquisition cost $91,000 in 2023, compared with $90,000 last year and $70,000 in the first quarter of 2021.

Table 3: Median sale price

arm’s length home sales in the City of Milwaukee

| Jan – March | bought buy | ||

| total | owner occupier | landlord | |

| 2018 Q1 | $100K | $140K | $50K |

| 2019 Q1 | $105K | $140K | $56K |

| 2020 Q1 | $120K | $155K | $62K |

| 2021 Q1 | $130K | $165K | $70K |

| 2022 Q1 | $148K | $185K | $90K |

| 2023 Q1 | $150K | $190K | $91K |

Around the city

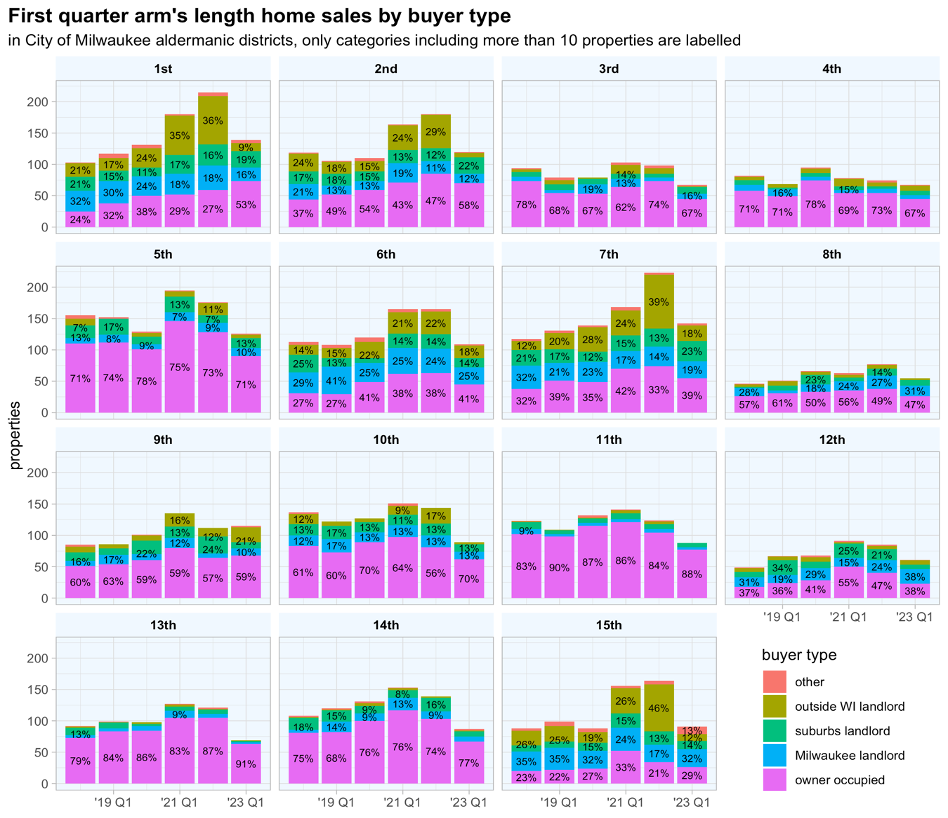

Compared to the first three months of 2022, sales in 2023 fell everywhere in the city except for the 9th aldermanic district on the far northwest side. Most of the other north side districts saw steep declines in the number of transactions–mainly driven by the reduction in out-of-state acquisitions.

In the 15th district, for example, fully 46% of purchases in Jan-March 2022 were made by an out-of-state landlord. That dropped to 12% in 2023. Similarly, out-of-state landlords bought more than two-thirds of the houses sold from Jan-March in the 1st district during both 2021 and 2022, but this year they only purchased 9%.

Noteworthy transactions

Despite the general slowdown in the real estate market, there were still several package sales of multiple houses. In the largest, RENTALVEST, LLC (a property flipper) bought 3 duplexes and 7 single-family homes from a local landlord for $555,000.

The largest 3 out-of-state landlords–all of whom spent the last two years aggressively buying properties–only reported a single transaction. VineBrook Homes bought one single-family house on N 52nd street for $115,000 from an owner in California. Neither Highgrove Holdings nor SFR3 recorded any purchases of any kind.

VineBrook is Milwaukee’s largest owner of single family homes and among the largest such landlords in the country. They purchased well over 300 houses in Milwaukee last year, so their essential freeze in acquisitions through the first quarter of 2023 is surprising. Their latest 10-K filing with the Securities and Exchange Commission points to some business difficulties. In 2021, they basically broke even, reporting a net income of $61,000. In 2022, they reported a net loss of $49,662,000. Their troubles haven’t ended in 2023. On January 17th, they terminated purchase agreements to buy “approximately” 2,899 more houses, forefeiting initial deposits of $41 million in the process.

High interest rates have clearly dampened buyer enthusiasm in Milwaukee’s housing market. Buying activity has declined the most among landlords–particularly ones located out-of-state. Would-be homebuyers today face somewhat fewer competitors than a year ago, but prices remain about the same.