Lessons for Law School Deans Regarding Catholics in Political Life

Let me again extend my appreciation to Deans Kearney and O’Hear for the opportunity to serve as December’s guest alumnus blogger of the month, and to all of you who joined the conversation in the comments section. I’ll be right there with you starting tomorrow. 🙂 Let me also take advantage of my month’s unique position on the calendar to wish you all a Merry Christmas and Happy New Year.

Let me again extend my appreciation to Deans Kearney and O’Hear for the opportunity to serve as December’s guest alumnus blogger of the month, and to all of you who joined the conversation in the comments section. I’ll be right there with you starting tomorrow. 🙂 Let me also take advantage of my month’s unique position on the calendar to wish you all a Merry Christmas and Happy New Year.

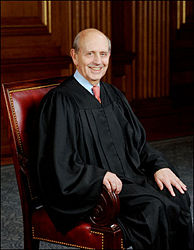

My final post is, in fact, the abstract of a piece I have just posted to SSRN. Earlier this year, you may have seen that Fordham’s law school received some heat from Edward Cardinal Egan, Archbishop of New York, for its decision to confer an award on pro-abortion Justice Stephen Breyer. The story led me to do some investigating, drawing in part on my own experiences as a Marquette student, and voila, an essay emerged. I hope to begin shopping it around to law reviews in the spring submission season.