Why Do Republicans Overperform in the Wisconsin State Assembly? Partisan Gerrymandering vs. Political Geography

(This essay is adapted from an On the Issues program with Craig Gilbert, Mike Gousha, and John Johnson. Click here to view that program in its entirety.)

Wisconsin has a confusing political personality. A casual observer might perceive it as a blue state. After all, 2016 is the only year a Democratic presidential candidate lost the state since 1984. On the other hand, it feels very purple when you consider that Barack Obama is the only presidential candidate since Michael Dukakis to win an outright majority of the vote. In still more ways, you might think this is a solidly red state. Republicans have controlled the State Assembly for all but three years of my lifetime. Rather than encouraging a mood of bipartisanship, I think this combination of red and blue traits leads many Republicans and Democrats alike to believe that they are the “true” representatives of Wisconsin who are only stymied by the illegitimate interference of the other party.

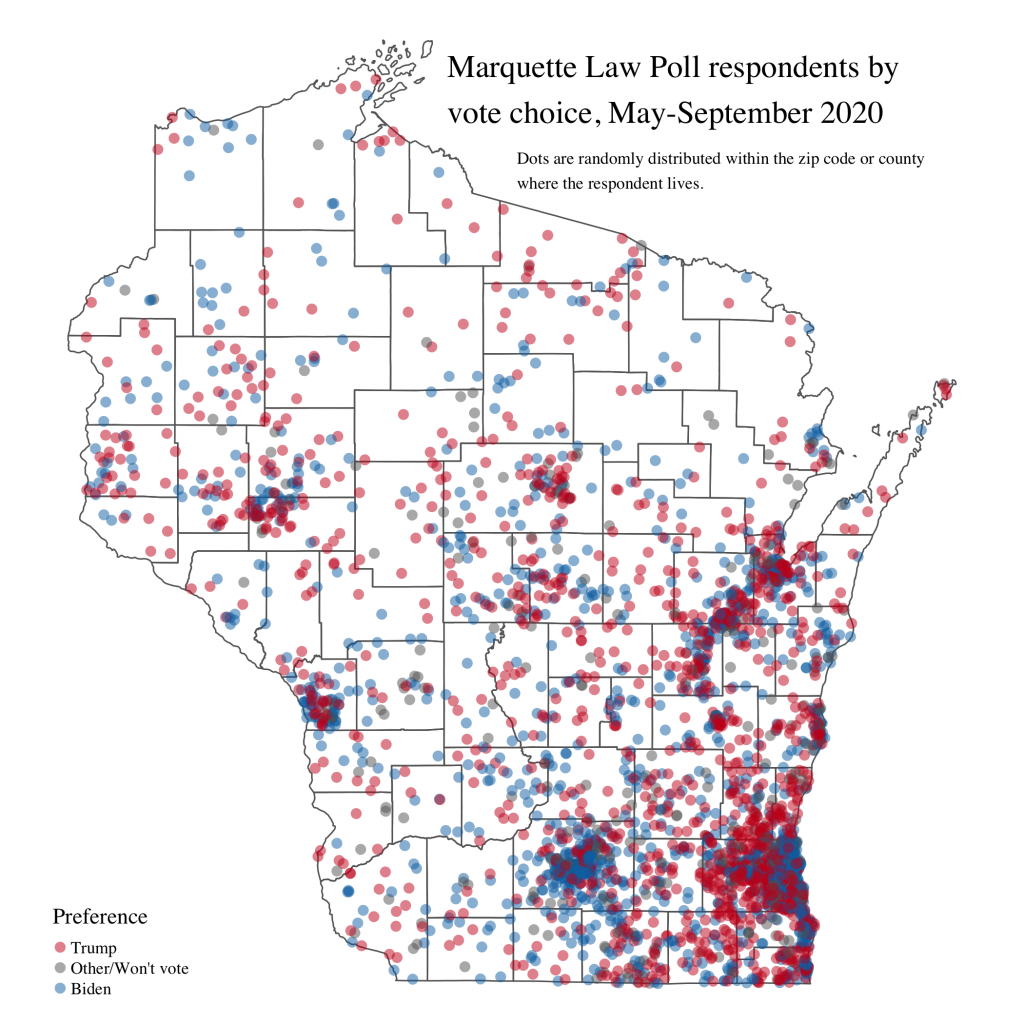

My preferred description is that Wisconsin, politically speaking, is not one moderate state; rather, it is one very conservative state overlapping another very liberal one. This state of affairs, after all, isn’t new. Wisconsin gave the nation the rabid anti-communist senator Joseph McCarthy at the same time Milwaukee elected its third mayor from the Socialist Party. The varied nature of Democratic and Republican coalitions in Wisconsin—both geographically and demographically—gives each party advantages in certain kinds of elections. Republicans have long performed better in the state legislature than their statewide vote share would suggest. This advantage accelerated after the 2011 redistricting, by some measures doubling their previous advantage. But how much of the built-in Republican advantage in the State Assembly is due to deliberate partisan gerrymandering and to what extent it is the natural consequence of Wisconsin’s political geography?