Mabel Watson Raimey

Recently a friend lent me a wonderful book, More than Petticoats: Remarkable Wisconsin Women, by Greta Anderson.* The book biographies a number of notable Wisconsin women, but the biography that stood out the most to me was of Mabel Watson Raimey.

Recently a friend lent me a wonderful book, More than Petticoats: Remarkable Wisconsin Women, by Greta Anderson.* The book biographies a number of notable Wisconsin women, but the biography that stood out the most to me was of Mabel Watson Raimey.

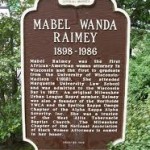

Mabel Watson Raimey was the first African-American woman to attend Marquette University Law School. (117) She worked during the day and went to law school at night. (117) She was the first African American female lawyer in Wisconsin, entering the profession in 1927. (118)

Ms. Raimey went to law school a few years after she was fired from her job teaching elementary school in Milwaukee: she was let go on the third day of school after school officials learned of her race. (114-15) Ms. Raimey had been a distinguished student before entering the teaching profession. (116) She graduated from West Division High School at fourteen and obtained an English degree at the University of Wisconsin. (116-17)

One of the activities that many of us faculty members undertake during the summer months is to clean out some drawers and shelves. While recently tackling that chore, I was thrilled to find an old tape from a 1999 conference we put on at the law school on “Spirituality and Work.” I had forgotten that Dean Howard Eisenberg was the luncheon keynote speaker that day. What a thrill for me to

One of the activities that many of us faculty members undertake during the summer months is to clean out some drawers and shelves. While recently tackling that chore, I was thrilled to find an old tape from a 1999 conference we put on at the law school on “Spirituality and Work.” I had forgotten that Dean Howard Eisenberg was the luncheon keynote speaker that day. What a thrill for me to