Trump’s Rhetoric, Proposed Policies, and the Rule of Law

For some, presumptive Republican nominee for president Donald J. Trump’s biggest appeal is his blustery persona and his take-no-prisoners attitude in his quest to “Make America Great Again.” For example, he started his campaign with a bold promise to build a wall on the United States border to keep out Mexican immigrants. More than that, Trump said, he would make Mexico pay for that wall. Mexican President Vincente Fox said Mexico would not and Trump just upped the ante. When Wolf Blitzer asked Trump how he would get the Mexican government to pay for a wall, Trump responded simply, “I will and the wall just got 10 feet taller, believe me.”

And, in the wake of the mass shooting at Pulse, the gay nightclub in Orlando, Trump renewed his call to profile on the basis of race/ethnic origin and religion, in order prevent future terrorist attacks. (The Pulse nightclub shooter was American-born and raised; his parents were refugees from Afghanistan, but his father became a naturalized American citizen.) Though claiming he hates the “concept” of profiling, he says other countries profile, and “it’s not the worst thing to do.” Earlier in his campaign, after the San Bernardino shooting in December 2015, he talked about increasing surveillance of Muslims and mosques and has suggested registering Muslims or mandating that they carry cards that identify them as Muslims.

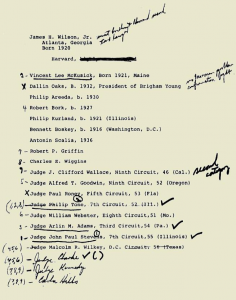

Trump also doesn’t suffer fools gladly—or more precisely, he doesn’t suffer his version of “fools” gladly. When the Honorable Gonzalo P. Curiel, the federal circuit judge presiding over two class action suits against Trump University, ordered documents in the suit be unsealed—documents that are likely to shed negative light on Trump University, Trump spoke loudly and often about Judge Curiel as a “hater” and biased against Trump because, in Trump’s view, Judge Curiel is Mexican and, presumably, would not like Trump’s wall. (Judge Curiel is an American, born in Indiana.) Trump went even further, seemingly threatening the judge: “They ought to look into Judge Curiel, because what Judge Curiel is doing is a total disgrace. . . . O.K.? But we will come back in November. Wouldn’t that be wild if I am president and come back and do a civil case?”

As well, just over a week ago, Trump revoked The Washington Post’s press credentials to cover his campaign because he did not like how it wrote about some of his comments after the mass shooting at Pulse, calling the publication “phony and dishonest.” Trump seems particularly thorny about The Washington Post’s owner, Jeff Bezos, who founded Amazon. Like Judge Curiel, Bezos has been on the receiving end of what seems very much like a Trump threat. According to The New York Times, Trump said in February about Bezos, “He owns Amazon. . . . He wants political influence so Amazon will benefit from it. That’s not right. And believe me, if I become president, oh do they have problems. They’re going to have such problems.”

These examples and more have a common theme: Trump’s disdain for the rule of law, if not outright ignorance of it.